A lot of people have not participated in any meaningful estate planning. Most people will admit that it is something they need to do, but keep putting it off. What is the reason?

Listed below are some common reasons why we procrastinate about estate planning:

(1) It is expensive

The reality is, most people do not have extra money lying around these days. However, not doing anything can end up costing your loved ones much more than it would cost you to plan now.

If you own assets in your name and you become incapacitated due to illness or injury, you (your assets and your care) will likely be placed in a court guardianship. This is not free. All costs (attorney fees, accounting fees, court costs, etc) will be paid from your assets and your family will probably have to ask the court for an allowance if they need money for living expenses.

This process does not replace probate when you die; your family will have to go through the court system again, and that means more expenses and less for your family. Your assets will be distributed according to Florida law, which probably won't be what you would have wanted.

Estate planning does not have to be expensive. You can start off with a simple will and then later upgrade to a trust when you can afford it.

(2) " I do not own enough"

Estate planning is not just for the wealthy. In fact, costs for a court guardianship and probate usually take a higher percentage from smaller estates (which can least afford it) than from larger ones. Even if you own a small amount, you would prefer to see it go to your loved ones than to courts and attorneys.

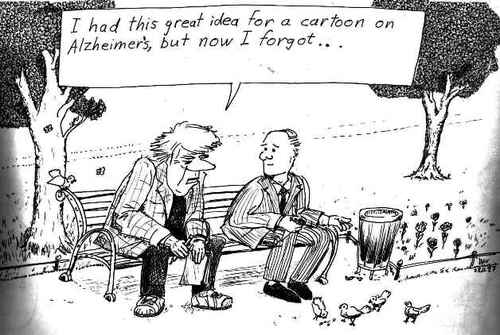

(3) " I am not old enough"

Estate planning is important for everyone (ages 18-100). Young people seem to think they are going to live forever. The reality is, that any of us, at any age, can become incapacitated or die due to an illness, injury, accident, or random act of violence. (Just read the newspaper or watch the evening news, you will see random acts of violence on a daily basis)

“Estate planning does not have to be expensive. You can start off with a simple will and then later upgrade to a trust when you can afford it.”

(4) It is too confusing. I do not know what to do:

Attorneys are called ' counselors at law' for a reason. An experienced estate planning attorney knows what other families have been through, knows what has worked well, and what has not. An experienced attorney can help you understand the process and make challenging decisions easier.

So why do we need estate planning?

· To make sure our assets will go the people we want to have them with the least amount of delay, hassle and expense

· To keep our families from having to deal with the courts if we become incapacitated and when we die

· Let our families know that we care about them, that we want to provide for them and protect them.

· We do it for love--but the huge benefit of estate planning: PEACE OF MIND

If you live in Miami-Dade, Broward, or Palm Beach county contact an experienced estate-planning attorney at The Hershey Law Firm, in Fort Lauderdale, Florida, at (954) 303-9468 to discuss your estate planning needs.

YOU CAN'T PREDICT THE FUTURE, BUT YOU CAN PLAN FOR IT!